Introduction

The secondary market for US life insurance policies offers a unique and stable investment opportunity. Unlike bonds and other asset classes, the valuation of life insurance policies shows minimal correlation with interest rate fluctuations, making it attractive to investors seeking diversification and lower volatility. Ress Capital has been a key player in this market, delivering strong returns over the years.

Life Insurance Investments vs. Bonds

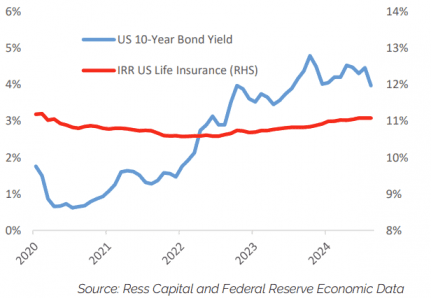

One of the most significant advantages of life insurance investments is their limited sensitivity to bond yield movements. From 2012 to 2024, while bond yields fluctuated dramatically, life insurance policy prices in the secondary market remained stable.

As can be seen in the graph below, the US 10-year government bond yield increased by 230 basis points between 2022 and 2024, yet the implied internal rate of return (IRR) on life insurance policies increased by just 50 basis points. This demonstrates that the asset class is largely unaffected by broader interest rate changes.

The Secondary Market for Life Insurance Policies

In this market, policyholders—often retirees—sell their life insurance policies when they no longer need coverage. These policies typically have greater value on the secondary market compared to the surrender value offered by insurers. Investors, such as Ress Capital, purchase the policies, providing policyholders with a better financial option while offering investors attractive returns.

The market is still small but growing, with increasing awareness among policyholders of the benefits of selling their policies to financial investors. This growth is driven by demographics rather than economic conditions, further insulating the asset class from interest rate volatility.

Why Life Insurance Investments are Resilient

The stability of life insurance policy prices is attributed to several factors. The supply of policies is primarily influenced by personal factors, such as reduced need for coverage, rather than economic changes. On the demand side, investors are primarily motivated by the opportunity to build exposure to an uncorrelated asset.

The longevity risk is largely disconnected from the broader financial markets. This makes life insurance policies an ideal investment for those looking for stable, long-term returns.

Outlook and Conclusion

Despite potential declines in bond yields over the next two years, Ress Capital expects the secondary market for US life insurance policies to continue providing strong gross returns of around 11%, with net returns of 7%. This stability, driven by demographic trends and long-term investor demand, makes life insurance policies a compelling alternative for those seeking consistent returns in a volatile market.

In summary, the secondary market for US life insurance policies offers a resilient and stable investment opportunity, with limited exposure to the fluctuations of the bond market. For investors looking for diversification and low correlation to traditional assets, this niche asset class presents an attractive option.

Click here to read the full report: Market Insight